Behind Capgemini's $3.3 Billion WNS Acquisition

And Crossing the Chasm with Agentic AI

Capgemini's $3.3 billion acquisition of WNS is a strategic response to an industry under siege from artificial intelligence.

Let’s think about it.

WNS wasn't a distressed seller. The company generated $1.27 billion in revenue last year with healthy 18.7% operating margins and steady 9% growth. It's exactly the kind of predictable, profitable business that institutional investors typically hold onto. Yet here we are, watching its shareholders take a 17% premium and head for the exits. The timing reveals what's really happening in the outsourcing industry - the fundamental economics of business process outsourcing are breaking down.

For decades, the model has been simple: take routine work from expensive Western markets and move it to places where labor costs a fraction of the price. Companies saved money, workers in developing markets got jobs, and BPO providers prospered. But artificial intelligence is systematically eliminating the need for these workers. Most enterprises today expect to replace professional services with AI-driven solutions within five year. With such seismic changes underway, enterprises have either intialized this process or at the least, they have started thinking about the implications of AI on their business. This is an extinction event for traditional labor arbitrage.

The math behind the Capgemini-WNS deal illustrates this shift perfectly. WNS's $1.3 billion in revenue represents just 5% of Capgemini's $25.5 billion business, but the headcount increase is a massive 19%. That disparity reveals the labor-intensive nature of traditional outsourcing and why it's becoming unsustainable. Capgemini isn't buying WNS for its workforce. It's buying the company's client relationships and process expertise, along with something more valuable: a credible platform for what it calls "Intelligent Operations."

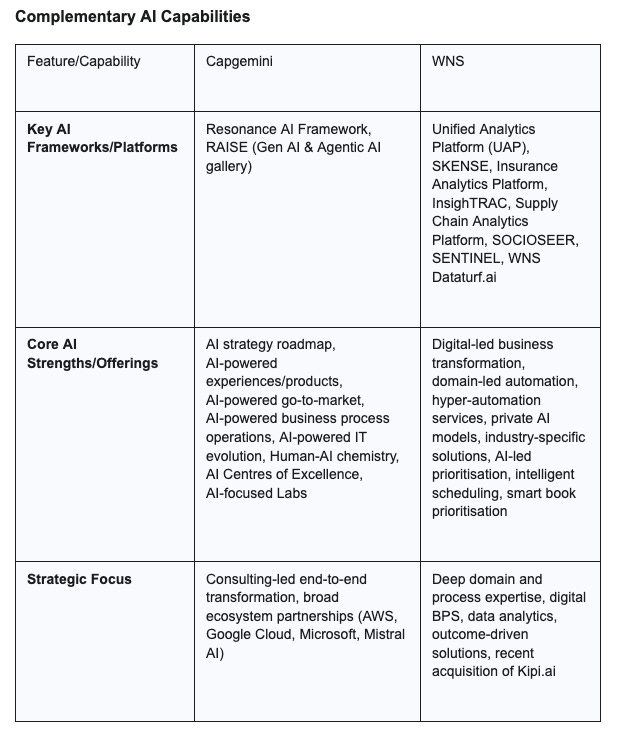

WNS has already built and deployed AI tools at scale - systems for processing unstructured data, analytics platforms for enterprise decision support, and trend analysis tools that are integrated into the daily operations of clients like United Airlines and Coca-Cola. Thus, the logic goes - Capgemini gets immediate access to WNS's deep domain expertise in insurance, healthcare, travel, and financial services, areas where it has historically been less dominant. More importantly, it acquires a client base that's actively seeking to replace traditional outsourcing with technology-driven solutions. Instead of spending years building these capabilities organically, Capgemini can immediately start mining WNS's existing relationships into transformation opportunities.

This acquisition shows a big shift in Capgemini's business model. The company has traditionally been a consulting and systems integration firm helping clients plan changes and then implementing them. With WNS, it's moving into actually running clients' core operations. This brings the promise of longer contracts and more predictable revenue, but it also means being responsible when things go wrong. There's less flexibility and more exposure to operational risks.

The execution challenge is substantial. WNS has 64,000 employees; Capgemini has over 300,000. They operate with different cultures, compensation structures, and service delivery methods. Integrating these organizations while simultaneously transforming both businesses around AI capabilities that are still evolving adds layers of complexity that have derailed other major deals. The financial projections are reasonable but not transformational - Capgemini expects 4% earnings per share accretion in 2026, rising to 7% in 2027, with €100-140 million in annual revenue synergies and €50-70 million in cost savings. These are respectable targets for a company of Capgemini's scale, but they don't justify the acquisition on financial metrics alone.

What makes this deal significant is what it signals about the future of business services. Every major player in this space is pursuing similar strategies around AI-powered operations. Accenture, IBM, Genpact, and others are all investing in comparable capabilities. The question is whether Capgemini's combination of WNS's domain expertise with its own consulting capabilities creates a meaningful competitive advantage in what's becoming a crowded field.

For traditional BPO companies, this deal serves as a warning. Pure-play outsourcing firms that built their businesses on labor arbitrage are losing ground to companies that can combine process expertise with advanced technology capabilities. The future is bright for firms that can orchestrate data, systems, and increasingly autonomous AI agents. This reflects a broader transformation in how businesses are thinking about operations. Instead of optimizing for lower costs through geographic arbitrage, companies are increasingly focused on eliminating human intervention altogether. They’re starting to look at AI as an integral part to how work gets done.

Success for Capgemini will depend entirely on execution. If Capgemini can successfully integrate WNS while delivering on the promise of AI-augmented business services, it positions itself at the center of a massive market transformation. If it fails, $3.3 billion becomes an expensive lesson.