Company Spotlight: Hexagon Nutrition

A Quiet Compounding Business Is About To Meet A Valuation Test

Hexagon Nutrition is a 30+ year old nutrition company that has largely stayed out of the spotlight while supplying behind the scenes building blocks of nutrition, both for packaged foods and for large public health programmes. For years it has operated more like a supplier to the ecosystem than a consumer facing story, which is why many investors may not recognise the name even if they have consumed popular products from Coca Cola, Marico, Amul and Dabur that use its premixes.

Hexagon first tried to list in 2021, when market conditions were supportive and the offer included a fresh issue along with an offer for sale. That plan did not go through. Since then, the business has improved on profitability, reduced debt and built a more balanced mix across premixes, branded clinical nutrition and programme linked products. So the story on paper looks stronger today.

But the biggest change in its attempt to list this time around is the purpose of the issue. As per the recent DRHP filed, the offer is largely about providing an exit to existing shareholders i.e. one brother out of the two who own the company. The company is not raising new money for expansion or a large growth plan.

For investors, this sets the tone. You are not buying into a big fundraising event that will immediately change the balance sheet. You are evaluating an established, technical, niche company and deciding whether its current cash flows, operating improvements and long term demand drivers are strong enough to justify the valuation, even without a fresh capital push.

From micronutrient lab to full nutrition platform

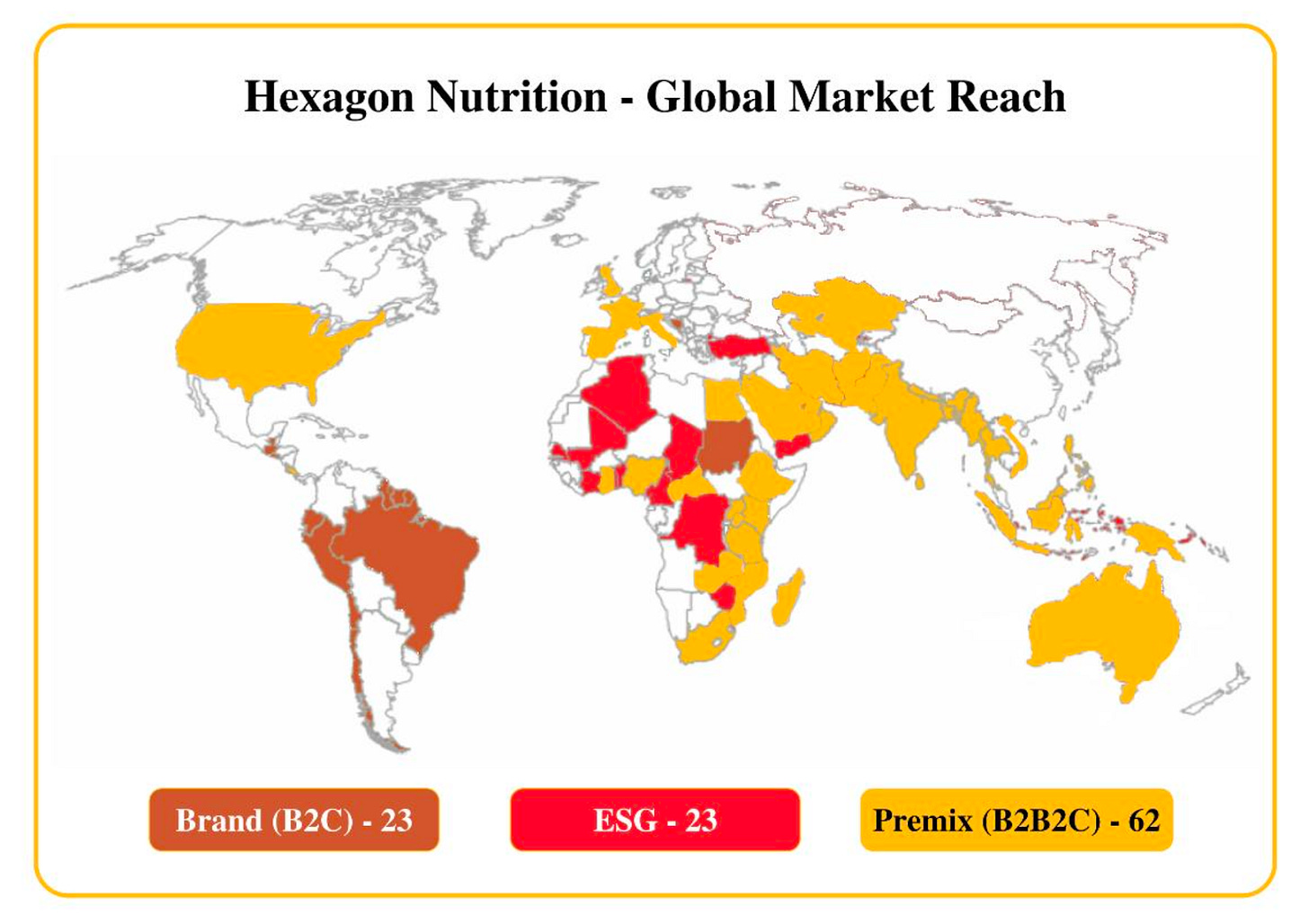

Hexagon Nutrition started in 1993 as a micronutrient formulations company. Over the years, it has moved up the value chain. Today it operates across premixes, branded nutrition and therapeutic nutrition supplied into public health and programme led channels. It has three manufacturing facilities, two in house research and development centres and a presence across more than seventy countries.

The business now runs on three linked engines.

First, premix formulations. These are supplied to large FMCG, dairy and beverage companies in a B2B2C model. In simple terms, Hexagon’s vitamin and mineral blends go inside fortified foods and drinks that eventually reach consumers through retail shelves.

Second, branded clinical and wellness nutrition. Products such as Pentasure, Obesigo and Pediagold are sold through hospitals and pharmacies, focused on specialised therapy areas like diabetes, renal and hepatic care.

Third, programme linked nutrition. This vertical makes ready to use foods and micronutrient powders for multilateral agencies and government led malnutrition and food fortification programmes.

FY25 segment numbers show the business is still led by premix, but not as heavily as before. Premix contributed around ₹155 crore, or 47.6 percent of revenue from operations. Branded clinical and wellness products contributed about ₹92 crore, or 28.3 percent. Therapeutic nutrition for ESG and programme linked channels contributed roughly ₹78 crore, or 24.0 percent.

So while premix remains the anchor, the overall portfolio is now more balanced. The logic is clear. Premix brings steady volumes and long customer relationships. Branded products typically carry better margins and benefit from rising demand for clinical nutrition. Programme linked products keep the company close to donor funded and policy driven nutrition initiatives, which tend to be sticky over long periods.

The numbers behind the narrative

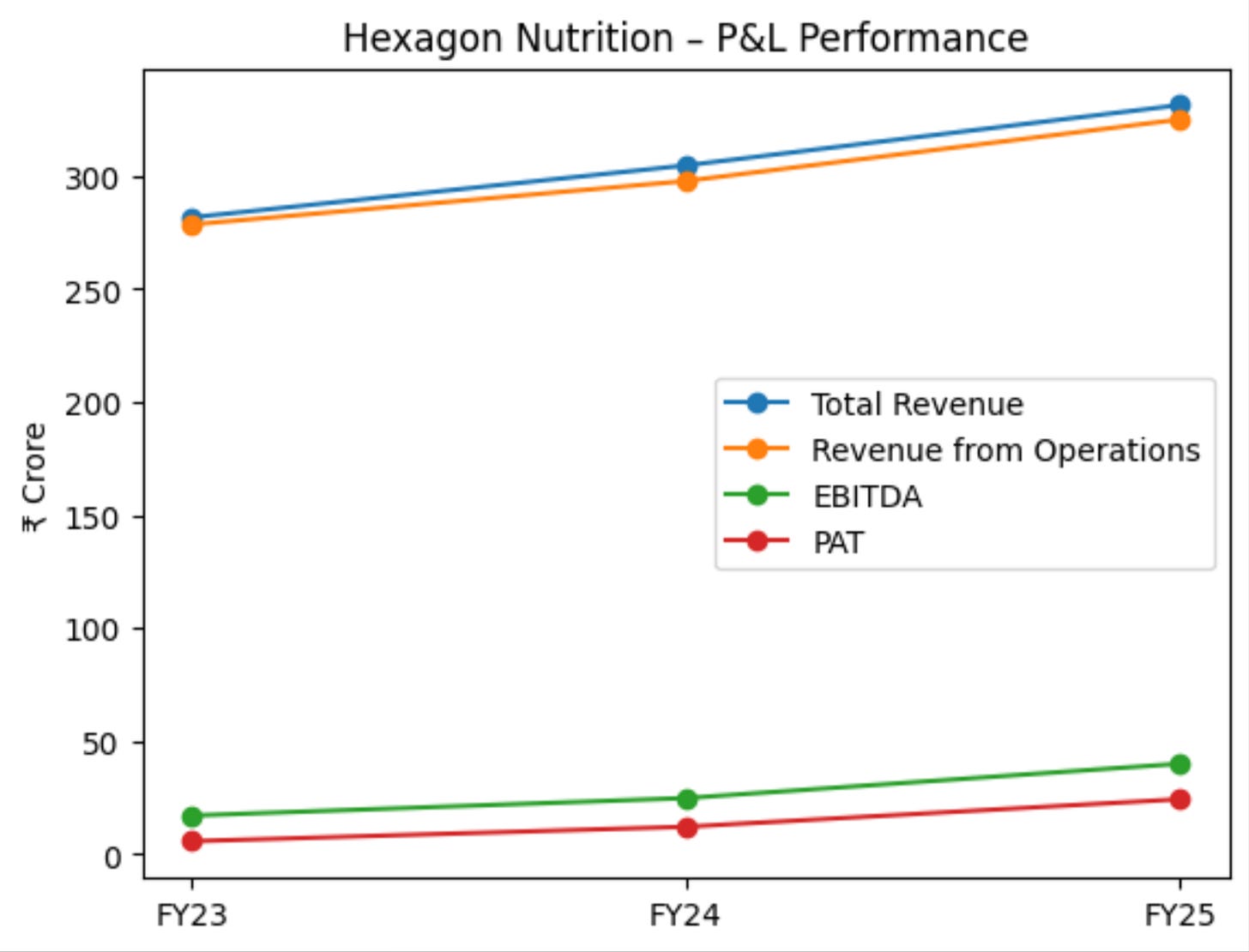

The cleanest way to read Hexagon’s recent performance is to look at FY23 to FY25. Net sales moved from ₹279 crore in FY23 to ₹325 crore in FY25. Over the same period, EBITDA improved from ₹17 crore to ₹40 crore, and net profit rose from ₹6 crore to ₹24 crore.

The bigger shift is in profitability and return ratios, not just the topline. Operating margin improved from 6.2 percent to 12.3 percent. Net profit margin moved up from 2.0 percent to 7.5 percent. Return on capital employed increased from 7.4 percent to 18.05 percent. Debt to equity also came down from 0.32 to 0.14, which shows the balance sheet has become lighter as earnings were retained and borrowings reduced.

FY25 growth was not flashy on revenue, but the profit jump was sharp. Revenue grew 9.1 percent year on year, while EBITDA grew nearly 61 percent, helped by margin expansion of roughly 400 basis points. For investors, this typically signals better cost control, better mix and better utilisation, not a business chasing growth at any cost.

There is still room to improve. Capacity utilisation has been low, which suggests meaningful operating leverage if demand scales without big new capex. At the same time, it also raises a basic question. In a competitive premix and nutrition market, how quickly and how profitably can Hexagon fill its plants.

A niche with real technical depth

The most distinctive part of the Hexagon story lies in its premix capabilities. Its research and development facilities are certified by the Department of Scientific and Industrial Research and focus on designing premixes that are stable, neutral in taste and tailored to each application and food matrix. This is a non-trivial exercise when multiple vitamins and minerals interact with different ingredients and processing conditions.

Independent industry consultants describe Hexagon as the largest customised premix player in India in terms of sales and capacity and one of the top ten globally. It is also identified as one of the largest licensed suppliers under United Nations programmes for micronutrient premixes.

This technical depth matters because premix is not a simple commodity blend. Formulating iron premixes alone can involve multiple salts and chemical forms that vary in colour and sensory properties and must be made compatible with the final food product. Companies that combine formulation skill with an understanding of client processes gain an advantage that is not easy to replicate.

On this axis Hexagon competes not just with domestic firms but with global ingredient majors. Its relative strength lies in being focused on premix and finished nutrition products, while for multinationals such as DSM or Glanbia this remains a smaller slice of a much larger portfolio.

Three decades of evolution and one private equity cycle

Overall, Hexagon’s journey looks like that of a typical promoter-led SME that has slowly become more organised over time. Key milestones include the launch of the Pentasure brand in 2009, setting up a second manufacturing unit in the Chennai SEZ in 2004, getting DSIR approval for the Chennai research centre in 2017 and receiving UNICEF approval for micronutrient powder production in 2018.

A major shift came in 2016 when healthcare focused private equity fund Somerset Indus invested through compulsorily convertible preference shares, along with the consolidation of group entities into one company. Somerset’s entry brought tighter board level oversight and a more formal capital structure.

The first IPO attempt in 2021 had both a fresh issue and an offer for sale and was meant to create an exit route for Somerset. That plan did not go through. In 2025, Somerset and co-investor Mayur Sirdesai exited through a secondary sale of their preference shares to Malani Ventures. Those securities were later sold onward to a wider set of high net worth and family office investors ahead of the new listing attempt. The company highlights this private equity exit alongside crossing ₹300 crore of annual turnover as an important milestone.

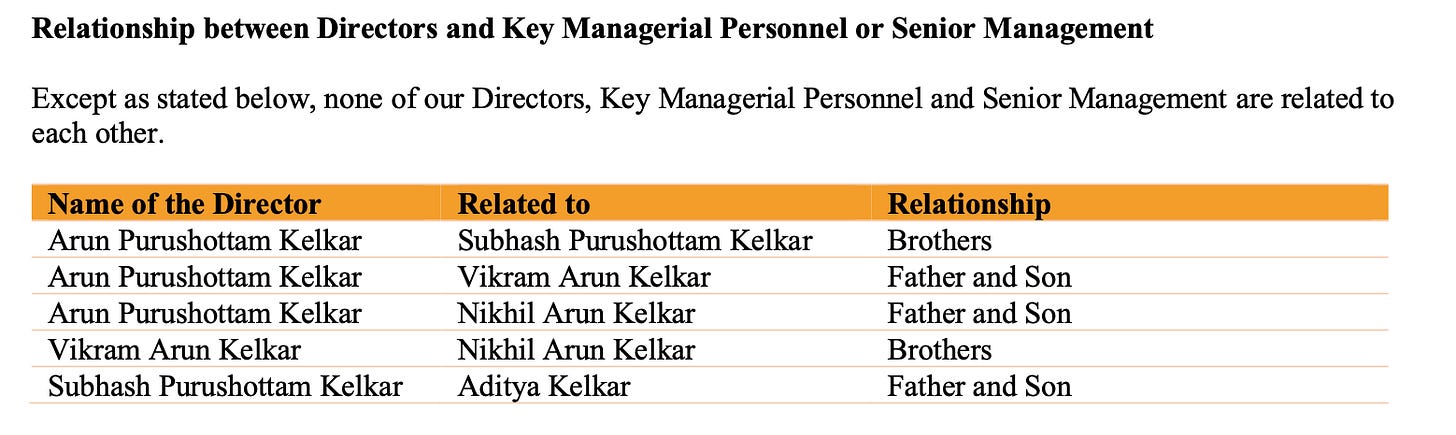

As a result, the shareholding coming to market is now cleaner. It is largely the Kelkar promoter family plus a spread of financial investors, without a large institutional sponsor acting as a governance anchor.

Offer structure and what it signals

The offer structure this time around is likely to be the biggest talking point in this listing. Unlike the 2021 listing attempt, which included a fresh issue, the current listing is fully an offer for sale. The company will not receive any proceeds. In simple terms, this is a liquidity event, not a fund raise.

The selling shareholders are all from the Kelkar promoter family. Subhash Purushottam Kelkar is the principal seller, with Arun Purushottam Kelkar, Nutan Subhash Kelkar and Aditya Kelkar also offering shares. Read plainly, this looks like one promoter branch taking a meaningful cash out, with smaller sell downs alongside.

The earlier private equity chapter is also largely behind the company now. With the institutional sponsor no longer on the cap table, public market investors will lean harder on governance and capital allocation discipline.

In this context, valuation becomes the make or break point. With a revenue base of about ₹325 crore, EBITDA of around ₹40 crore and net profit of roughly ₹24 crore, the cleaner way to look at pricing is through earnings multiples. A market capitalisation in the ₹250 to ₹300 crore range implies about 10 to 12 times FY25 earnings. In that band, the offer for sale structure is easier to accept because the pricing leaves room for normal business risks. But once the valuation moves to ₹350 crore and above, the same business starts getting priced in the mid teens on earnings, without any fresh capital coming into the company. At that level, the market is effectively paying upfront for sustained margins, higher utilisation and clean execution, and scrutiny naturally rises because there is less margin for error.

The risks

The company is more candid than many small and mid sized issuers in its discussion of risk factors. It acknowledges that revenue continues to rely substantially on the premix vertical and that any disruption in this segment would have a significant impact on performance. It also flags regulatory changes in food fortification standards, volatility in vitamin and mineral prices and the imported nature of key inputs as potential pressure points for margins and volumes.

Customer and geography concentration are visible in the disclosures. A small set of customers contributes a meaningful portion of sales and in some years revenue from a single export country has crossed ten percent of the total. The ESG oriented segment, which depends on multilateral tenders and government contracts, is inherently exposed to shifts in donor budgets and policy priorities.

Opportunity and valuation lens

On the opportunity side, Hexagon sits at the intersection of several durable themes. Public and regulatory attention on food fortification continues to rise. Dietary habits are changing, clinical nutrition is gaining ground in a country facing a growing burden of lifestyle disease and global funding for child and maternal nutrition remains a priority for many multilateral agencies.

The company’s recognised research capabilities, approvals for micronutrient powder production and position as a leading premix supplier into United Nations linked programmes give it credentials that are not easy for new entrants to copy quickly.

At the same time, this is not a consumption glamour story. Scale remains modest by listed consumer standards. The recent improvement in margins and returns has yet to be tested across a full cycle of donor budget cuts or sharp input price spikes. For investors, Hexagon is best viewed as a technically strong, improving franchise in a relevant niche that can reward them if bought at a sensible valuation.

As with many SME style listings, the real work will begin after the bell rings. How the company sustains its uplift in profitability, manages a working capital intensive model and uses its public equity as a strategic currency will determine whether this second attempt at the market finally turns a quiet nutrition specialist into a steady compounder on Dalal Street.