GCCs Are Here to Stay

A data story

Global Capability Centers, or GCCs, are company owned teams in India that support global operations. For a long time, they were misinterpreted as back offices, a way to get work done at lower cost. However, data suggests a different story. It shows that GCCs are becoming long term, leadership staffed centers where companies build and run important parts of the business.

Key indicators of which being - GCCs are concentrated in dominant talent hubs, they span industries far beyond pure tech, they often have senior leadership and dedicated HR leadership, they range from specialist teams to massive centers, and many have existed for more than a decade. A growth in GCCs is essential to support the India-story in this AI age.

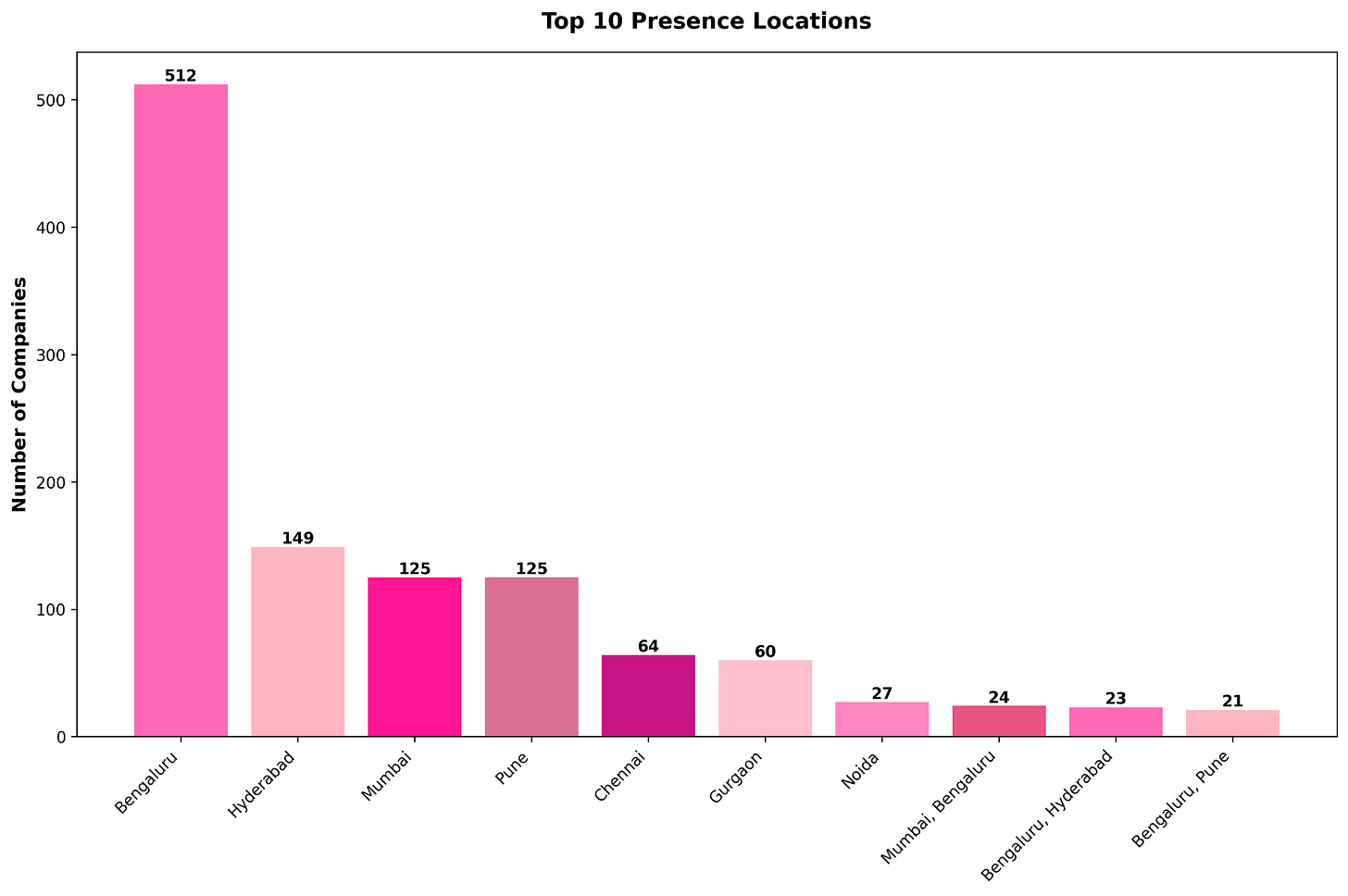

Bangalore remains the undisputed hub

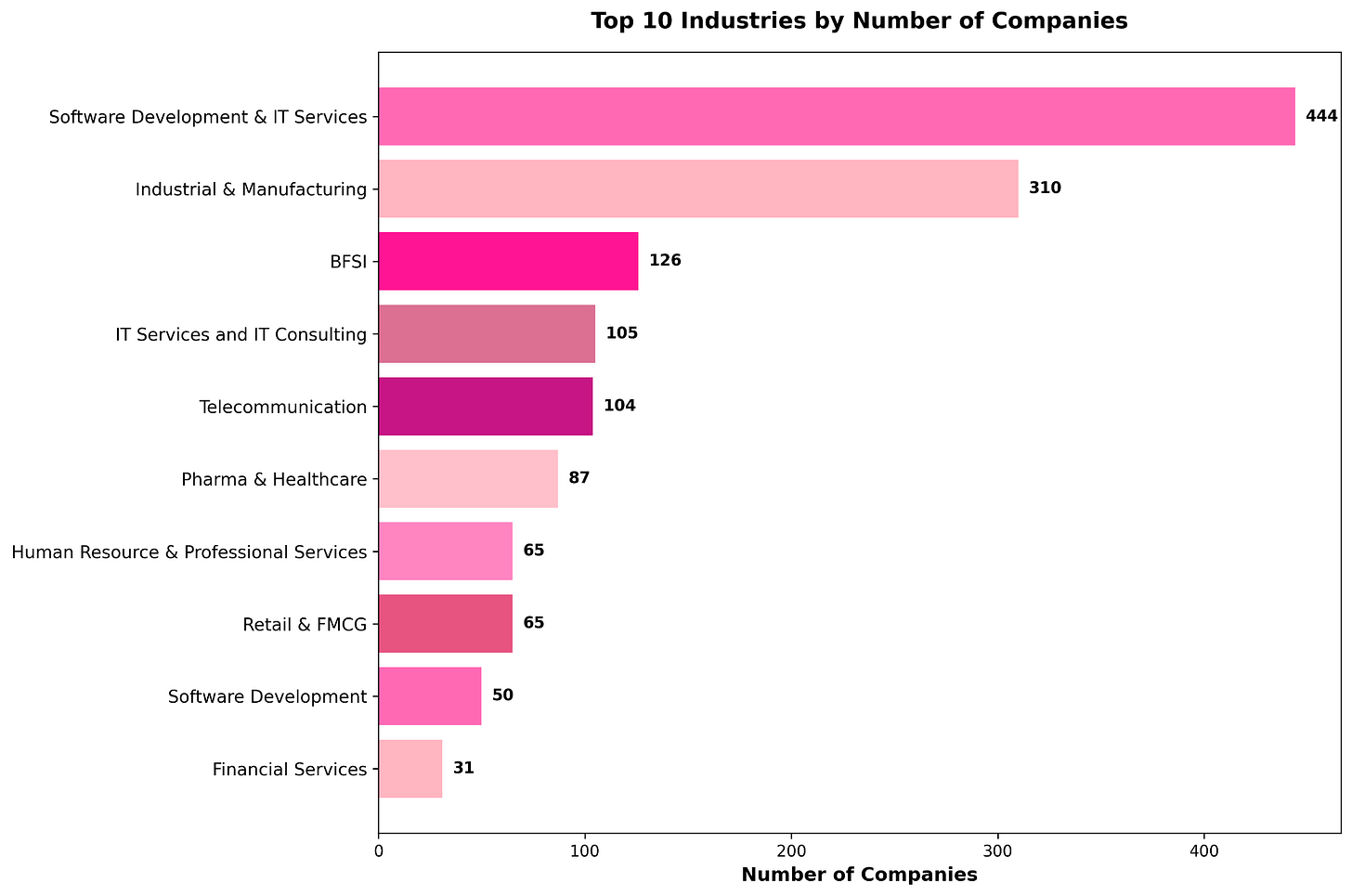

It goes beyond IT services

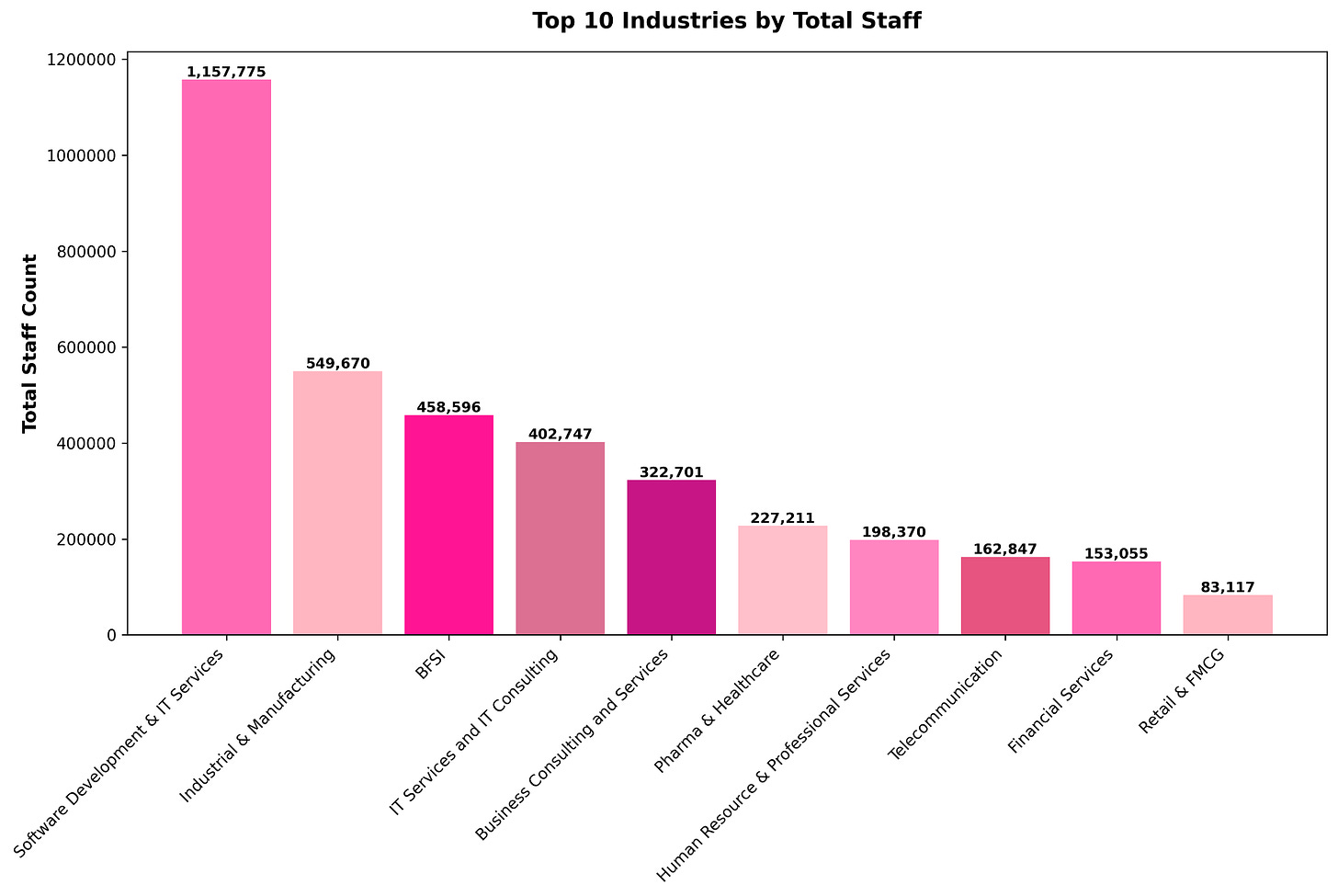

Although, IT Services remains the largest employer

Amidst slowing globalisation and India-US skirmishes, the setup of new GCCs has slowed down. Although the ones who’re here have been expanding their footprint.

In the recent analyst briefings of Embassy Office Parks REIT, it was stated that -

The key demand driver continues to be global corporates who are setting up or expanding their GCCs in India. In the past 3 years, almost 70% of our leasing has been to GCC clients.

On the talent side, Quess Corp calls out GCC led revenue mix in its Professional Staffing business: “deeper engagements with global capability centers, which now contribute 73% of segment revenues.”

The same shows up in Mindspace Business Parks REIT earnings call commentary that synthesises broker research. Mindspace cites JLL estimates for 2025, noting that GCC led demand reached 31.4 million square feet and accounted for 38 percent of total leasing. It also cites a 2026 view from CBRE, which says GCCs are expected to drive 35 percent to 40 percent of total absorption in 2026.

The market signal is clear as day - GCCs are increasingly becoming the base load demand for specialised hiring in India’s top clusters. This is good for India. GCCs bring long duration problem statements, budgets, and leadership owned mandates into top talent clusters, and AI (being used increasingly) turns that proximity into measurable productivity gains, faster delivery, and a shift from executing tasks to owning platforms and products. This rise along the value chain creates spillovers - higher value jobs and wages, deeper upskilling, more founder and specialist talent leaving GCCs to build startups, and a stronger export engine that is less exposed to traditional services cycles.