Private Credit Is Eating Private Equity’s Lunch

Private credit isn’t the sideshow anymore. It’s the main act powering India’s mid-market engines.

For much of the last decade, private credit in India was shorthand for two things: either a distressed asset no one else would touch or a high-yield real estate loan that couldn't clear a bank’s credit filter. That perception is now outdated.

In the last two years, private credit has moved from the margins to the mainstream of India’s mid-market capital stack. It’s no longer Plan B. Increasingly, it's the capital strategy of choice for businesses seeking speed, structure, and control - traits in short supply in today's equity and bank-led environments.

It's a structural shift driven by evolving needs on the demand side and deepening sophistication on the supply side.

The Capital Supply Gap Is Real And Growing

India’s macroeconomic story remains strong: 6.5–7% GDP growth projected for FY25, solid corporate earnings, and a relatively stable rupee. But growth capital—especially flexible, fast, and founder-aligned capital—remains elusive for many.

Venture capital has pulled back from its 2021 high. Private equity firms are active but more cautious, leaning into exits over fresh deployment. Banks continue to expand credit, but largely to large caps and retail borrowers.

That leaves a financing vacuum for mid-market firms, particularly those clocking ₹100–1,000 crore in annual revenues. These are companies consolidating markets, building capacity, or prepping for IPOs. They need capital quickly but aren’t willing to endure heavy dilution or slow timelines.

Private credit is stepping up with structured solutions: customised tenors, covenant-light instruments, and promoter-first terms.

Private Credit’s Surge

The data tells the story. In 2024, Indian companies raised $9.2 billion across 163 private credit deals—a 47% jump in volume over the prior year. The first half of 2025 already suggests the market will break the $10 billion threshold.

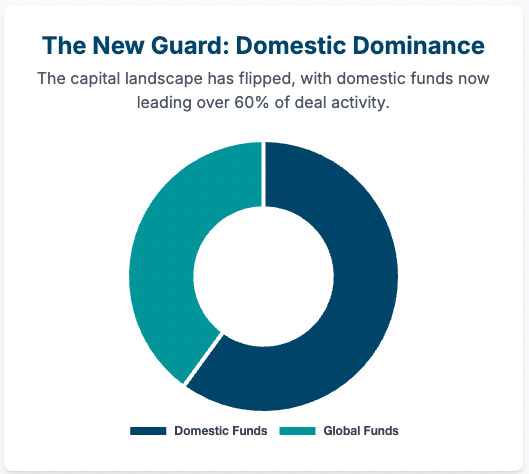

Crucially, the capital mix has changed. Over 60% of deal activity is now led by domestic funds, flipping the earlier dominance of global special-situation players.

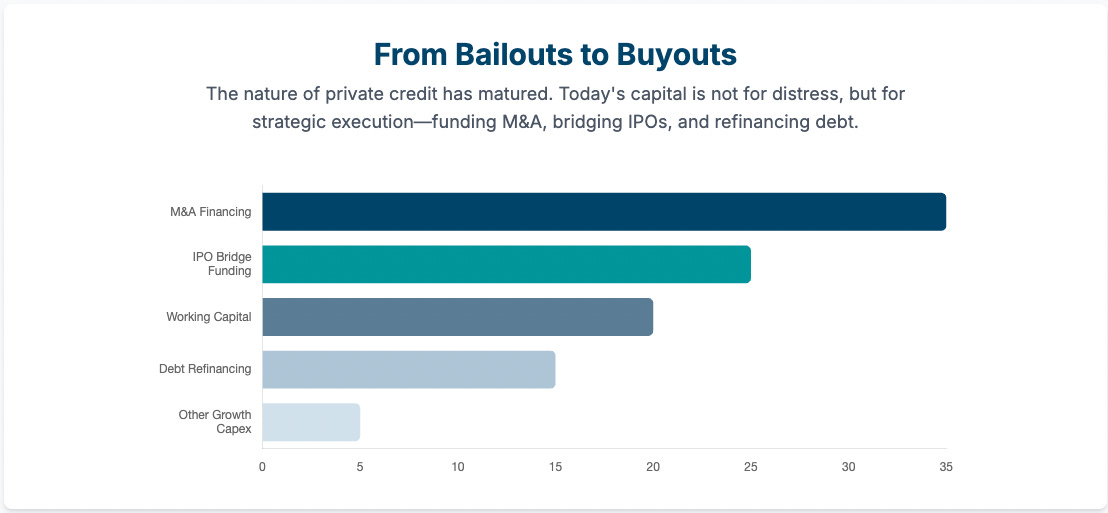

And the nature of credit has matured. Most deals today are performing credit, not distress which means capital is now being used for M&A, IPO bridges, working capital, and debt refinancing, rather than bailouts.

Demand Is Broad-Based And Deepening

Private credit demand is now visible across sectors:

Healthcare: Matrix Pharma raised ₹2,400 crore via structured credit for its acquisition of Viatris’s API unit. Manipal Health secured ₹800 crore from 360 One for expansion.

Fintech: With tighter equity conditions, fintechs are raising structured debt for onward lending. InCred, Northern Arc, and Stride Ventures are driving mid-sized transactions in the ₹100–300 crore range.

Renewables: Greenko raised ₹460 crore in debt for a solar SPV. FPEL Saur Vidyut locked in ₹120 crore from domestic funds for EPC-linked capex.

Other Sectors: Logistics, data centres, and packaging firms are using credit via listed NCDs, mezzanine paper, and zero-coupon bonds—typically to fund capex or bridge growth stages that banks won’t underwrite.

Why Promoters Prefer Credit Over Equity

The promoter rationale is clear: private credit is faster, cleaner, and non-dilutive.

Deals typically close in 4–6 weeks. Lenders rarely seek board seats. And while interest costs are steep(14–17% IRR), they’re fixed, predictable, and short-duration.

In a market where public equity remains selective and valuations are compressed, founders are opting to extend runways or pursue strategic goals through credit rather than issue equity at a discount.

Instruments are increasingly used to:

Delay equity rounds until pricing improves

Fund acquisitions or capex

Unlock promoter liquidity with minimal governance friction

The LP View: Yield, Predictability, Control

Institutional capital is showing a strong appetite for private credit too.

Indian credit funds are delivering 15–17% IRRs with lower beta to public markets. LPs—especially family offices, insurers, and pensions—value the predictability of return profiles based on interest and principal recovery, not just valuation mark-ups.

Some are allocated through funds. Others are going direct—especially in the ₹50–100 crore range—seeking yield and greater control over terms and structuring.

But Risk Is Creeping In

Rapid growth brings its challenges.

Competition is driving yield compression and occasional structural dilution. As dry powder chases a finite pipeline, credit quality could suffer.

Enforcement remains weak. Despite improvements, India’s insolvency and recovery ecosystem—especially via IBC—remains slow and resource-heavy. Credit deals now require layered protections: escrow accounts, promoter guarantees, senior liens, and cash-flow sweeps.

There’s also the borrower-side risk. Not all promoters fully grasp the burden of predictable repayment. Credit is not equity, it demands discipline.

Lenders will need to balance creativity in structuring with caution in underwriting. The onus is now shared.

The Bottom Line

Private credit in India has outgrown its shadow. It’s no longer a last resort and often the first call. As traditional capital sources fall short, this asset class is rewriting the mid-market financing playbook. The question is no longer if private credit will scale—it’s how smartly and sustainably it can do so.