Are Platforms and Infra Players Disrupting the Power Balance of the Banks?

The Embedded Finance Realignment

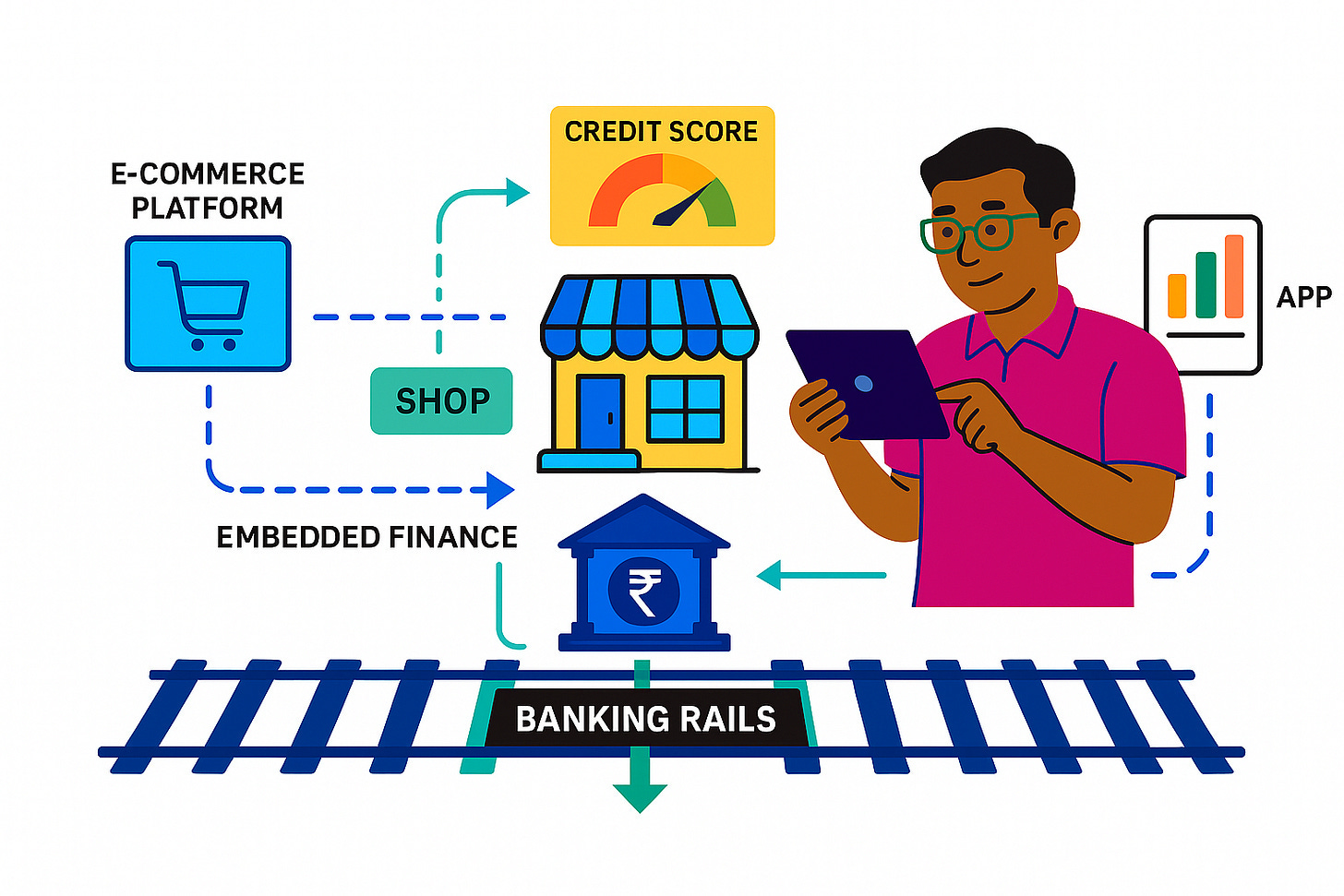

India’s financial services stack is going through a redistribution of value. Embedded finance is dissolving the traditional boundaries between banks, fintechs, and distributors.

At the centre of this shift is an emerging fact that banks no longer own the user, the interface, or the engagement. Platforms do. Infrastructure players enable them. Banks, if unadapted, are reduced to balance sheet utilities.

Banks rely on bureau data and static income, whereas platforms have behavioural data: cash flow patterns, order history, repayment velocity, giving them edge in underwriting, especially for new-to-credit users.

New age fintech players evaluate borrowers differently than traditional NBFCs.

Traditional banks need to play to their strengths i.e low-cost capital, trust, and regulatory leverage - while plugging into this new stack as infrastructure. Partnering with fintechs or building embedded finance rails (like a big private Bank has done with its open APIs) is the way forward to reach to the larger audience and bottom of the pyramid, where this credit will create actual meaningful impact

Ganesh Jha, CEO & Co-Founder at FinoFii

This article outlines how and why the power centre in financial services is moving toward APIs and platforms and how capital should position itself accordingly across BFSI incumbents, infra rails, and MSME credit originators. Let’s dig in.

Core Thesis - Banks Are Becoming Balance Sheet Providers, Not Distribution Gatekeepers

India’s financial infrastructure has matured at an unprecedented pace:

1.6+ billion bank accounts

18B+ UPI transactions/month

₹24+ lakh crore in digital transaction volume (June 2025)

Yet financial intermediation is no longer bank-led. The user journeys, whether for credit, savings, insurance, or liquidity, are increasingly owned by:

Platforms: E-commerce, logistics, ERPs, and retail networks

Infrastructure APIs: Underwriting, KYC, collections, compliance stacks

Alternative capital vehicles: Fintech-originated NBFCs, private credit warehouses

Financial services are thus becoming contextual layers, not destinations.

The Shift From Products to Protocols

Thriving in embedded finance demands an operating model overhaul. Banks must now move from product manufacturers to modular enablers, which involves:

Tech Re-architecture: Incumbents must offer API-first, interoperable stacks. Initiatives like RBI’s Unified Lending Interface (ULI) will make plug-and-play participation a baseline, not a bonus.

Data-Driven Underwriting: Static credit models no longer suffice. Lenders must ingest partner platform data (e.g., GST, commerce flows) and co-underwrite via shared-risk models like co-lending or FLDGs.

High-Volume, Low-Margin Economics: Embedded credit often means ₹5K–₹50K ticket sizes. Automation, low CAC, and revenue-sharing with platforms are prerequisites for profitability.

Regulatory Traceability: RBI’s digital lending norms and DPDP compliance demand real-time audit trails. "Compliance-as-a-service" is emerging as a fintech moat.

The Implications Of This

The cost of customer acquisition (CAC) is plummeting for platform-embedded models. Banks still operate at CACs 3–5x higher in SME segments.

Margins are being redistributed: The origination layer, i.e. the interface, is capturing more fee revenue and lifetime value than the underwriting entity.

Risk and capital are decoupling: The entity pricing the loan is no longer the one taking balance sheet risk. This creates new models of co-lending, FLDGs, and synthetic securitisation.

Regulatory rails are reinforcing interoperability, not incumbent dominance. UPI, OCEN, Account Aggregator, and ULI standardise credit, data, and consent, not in favour of banks, but in favour of whoever orchestrates demand best.

The Data Dominance Behind Distribution Power

Platforms control first-party behavioural data: transaction patterns, restock frequency, SKU churn, and delivery reliability. This is richer than bureau scores. Infrastructure players translate this into underwriting and product decision-making, often superior to traditional models. With Account Aggregators, a consent-based data flow is programmable and secure; however, the ability to request consent depends on the frequency of user interaction. Again, platforms win.

Key insight here is that the most predictive risk models will be built on proprietary context + consented ecosystem data. Banks can’t access this unless they are embedded or standardised partnerships.

For investors, this means underwriting ability is no longer confined to NBFCs and banks. It can live in a B2B software layer. That is the alpha.

Who Wins in the Embedded Ecosystem?

No single player will dominate but some roles will earn outsize leverage:

Infra Players who set standards (ULI, OCEN, AA) will become default gateways and gatekeepers.

Platforms that own user engagement and behavioural data will dictate credit origination economics.

Banks that embrace backend roles will scale capital deployment efficiently but invisibly.

Success hinges on aligned incentives, shared data, and tight collaboration. In embedded finance, the most indispensable players are often the least visible. The winners might not own the customer but they might own the rail the customer runs on.

Strategic Forecast: 4 Forces Reshaping Financial Services

Banks Become Protocols: Utility backends with product APIs and co-lending pipes. Margins drop, volumes rise for those willing to become embedded.

Infra APIs Gain Pricing Power: The “Switch” becomes the standard. These layers will set the rules of engagement, compliance, and economics.

Platform-Led Credit Emerges as Default: Whether it's Zomato financing restaurants or DeHaat underwriting farmers, platforms will increasingly become lenders-in-disguise.

Invisible Finance Wins Trust: Customers won't know who funded them. They will remember the interface that solved their problem instantly and in context.

Case in Point: Proof Points of Embedded Advantage

M1xchange: ₹1+ trillion in invoice discounting. Bank funds the transaction; the platform controls risk via buyer credentials and invoice flows. The credit UI is outsourced.

Kissht: Embedded lending API stack powering BNPL across multiple merchants. Credit-as-a-service, monetised via take-rate + underwriting edge.

RUGR: Crop loans and micro-insurance inside vernacular agri-platforms. Focused on kirana tech, SHGs, and cooperative networks. Credit decisions are made hyper-locally, but capital is piped through embedded NBFC rails.

Target Exposure: Betting on the Connective Tissue

To navigate the embedded finance shift effectively, capital must be deployed across three high-leverage layers of the stack: regulated BFSI institutions evolving into backend enablers, infrastructure API firms standardising financial connectivity, and embedded credit originators leveraging proprietary distribution.

The following map outlines key players shaping each layer.

1. BFSI Incumbents: Play Protocol, Not Platform

For allocators with exposure to legacy banks or NBFCs, we recommend a re-evaluation of strategy. Banks are not obsolete—but their distribution edge is gone. What remains is:

Regulatory legitimacy

Low-cost capital access

Risk management expertise

Infrastructure-grade trust with regulators

These are strengths, but only if repositioned as platform-agnostic utilities.

Forward-looking BFSI players (e.g. Unity SFB, Axis Bank, DBS India) are positioning to:

Offer APIs for partner integration

Enable co-lending pipes with dynamic pricing

Offload origination to ecosystem participants

What to avoid: BFSI players building in-house “superapps” without platform partnerships. That game is capital-intensive, low-NPS, and structurally defensive. Rather, the best bank investments will be those that behave like cloud providers: ubiquitous, secure, silent, but indispensable.

2. Fintech Infrastructure APIs: Rail Power, Not Retail Churn

This is the picks-and-shovels layer. Firms building KYC, underwriting, disbursement, account creation, and collections APIs are becoming central to embedded finance economics.

Characteristics to favour:

Category-defining in a function (e.g. Signzy for onboarding, M2P for card issuance, Decentro for KYC + UPI)

Tightly integrated with public digital infrastructure (AA, UPI, ULI, OCEN)

Offering compliance-as-a-service, especially post-DPDP

Revenue is often low in early stages (SaaS-like), but high embeddedness leads to vendor lock-in + data flywheel.

Pricing models are evolving from per-call to per-loan to tiered take-rate on credit deployed. The winning APIs will graduate from commodity utilities to network effect platforms.

All in all, the infra layer is a long-duration compounder, with lower volatility and deeper moats than B2C fintechs.

3. MSME Credit: Distribution Is the Differentiator

India’s 63M MSMEs represent a $500B+ credit gap. Traditional underwriting is slow, collateral-dependent, and expensive. Embedded MSME lenders are solving this by:

Leveraging platform signals: order frequency, delivery accuracy, seasonal working capital needs

Integrating with vertical platforms: B2B commerce, invoicing, payroll, logistics, inventory

Offering contextual products: invoice discounting, BNPL for inventory, revenue-based loans

We’re bullish on:

Lenders with proprietary data pipes (e.g., OfBusiness, Progcap)

B2B SaaS + credit hybrids: where the software pays for CAC, and lending monetises LTV

Fintech-NBFCs with risk-sharing models (FLDG, pooled underwriting, dynamic rates)

Key metrics to track:

CAC-to-LTV ratio (<1:5)

GNPA stability over 3+ cycles

Embedded partner concentration (<20% revenue reliance on any single partner)

MSME credit will be platform-sourced, infra-underwritten, and privately securitised. The dominant originators will not be banks, but software.

To Conclude…

The next decade will not be about “digitising banking.” It will be about decentralising it.

Banks will not disappear but their unit economics and brand equity will diminish.

Platforms will not become banks, but they will originate most financial flows.

Infra providers will not lend, but they will control who gets to.

For capital allocators, the direction is set: The embedded finance stack is where the next moats are being built. Distribution is upstream. The balance sheet is interchangeable.

Sharp thesis on the redistribution of value in embedded finance—especially the point about platforms leveraging behavioral data (cash flow patterns, order velocity) for underwriting where traditional banks can't. This shift is reshaping B2B credit and working capital access at the operational level. TCLM explores similar terrain from a trade credit and liquidity-risk angle, often highlighting how payment terms and financing embed into platforms. A valuable read.

(It’s free)- https://tradecredit.substack.com/