The India Hospitals Report 2025: Capital, Capacity, and the Calculus of Care

An Analytical Deep Dive into India’s Shifting Healthcare Ecosystem

The hospital sector in India has long been viewed through a bifurcated lens: a critical, yet highly fragmented, social necessity. Today, in 2025, that narrative is being ruthlessly redrawn. We are witnessing not merely growth, but an institutional coup d’état. The traditional landscape of doctor-promoter-led, regional hospitals is rapidly ceding ground to a new cohort of corporatised, institutionally-backed behemoths, bankrolled by a potent combination of global Private Equity, Sovereign Wealth Funds, and aggressive domestic capital.

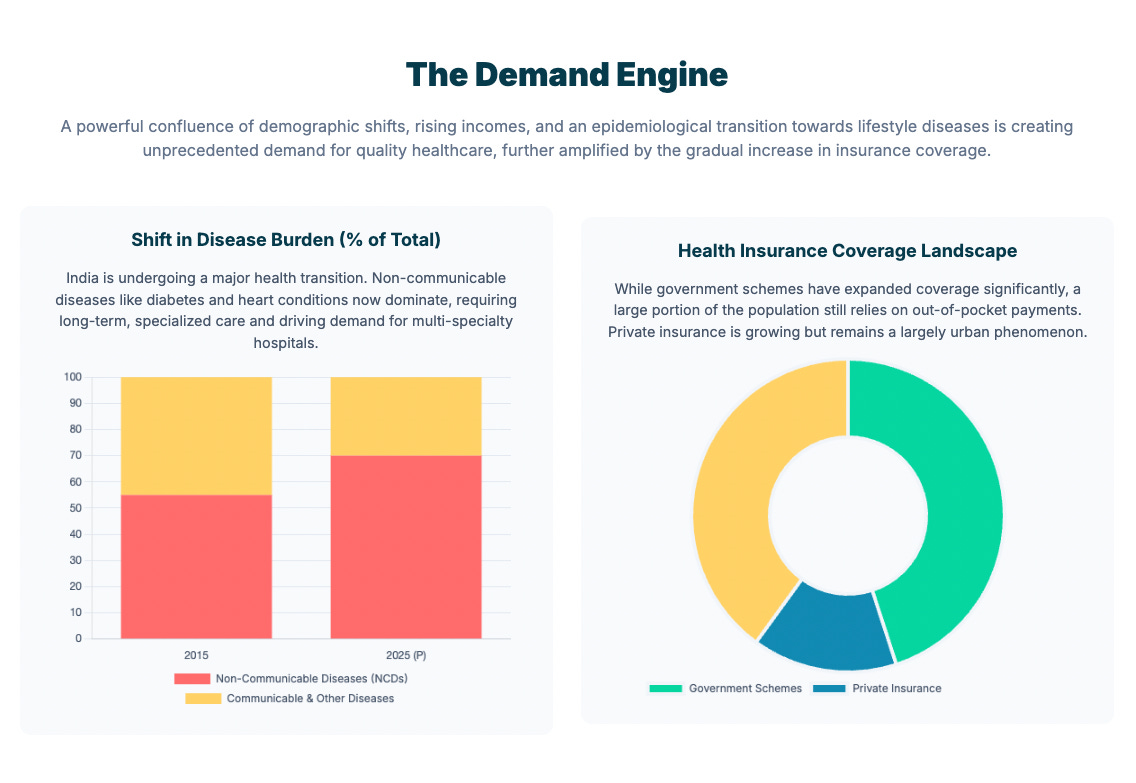

This transition is being catalysed by four forces converging in a moment of acute financial and demographic stress: 1) an aging population, 2) the relentless epidemiological shift towards high-cost, 3) chronic Non-Communicable Diseases (NCDs), and 4) the strategic deployment of billions in capital seeking inflation-resilient, secular returns.

The critical question is no longer if the market will consolidate, but how this convergence of capital and urgent societal need will reprice the very foundation of Indian healthcare.

This article goes beyond simple market sizing. It is crafted for the discerning investor, the strategic operator, and the policymaker navigating the turbulence of this transition. It will explore the new calculus of capacity, capital structure, and policy risk; diving deep into the strategic architecture that will determine who wins the coming decade of hospital expansion, and at what cost to the end consumer. The story of Indian healthcare is evolving from a humanitarian challenge into a high-alpha asset class. Understanding its dynamics is essential to anyone seeking to navigate one of Asia’s most compelling and critical growth frontiers.

Part I: The New Calculus of Capacity and Capital

The Market Scale: A Decade of Double-Digit Expansion

The Indian hospital market, valued at approximately $108.57 billion in 2024, is not just growing; it is fundamentally restructuring. Projections indicate a climb to $197.31 billion by 2030, reflecting a robust Compound Annual Growth Rate (CAGR) of 10.64%. This expansion is fuelled by an underlying epidemiological shift: the increasing contribution of Non-Communicable Diseases (NCDs) and injuries to the total disease burden, a trend that drives demand for complex, tertiary, and quaternary care.

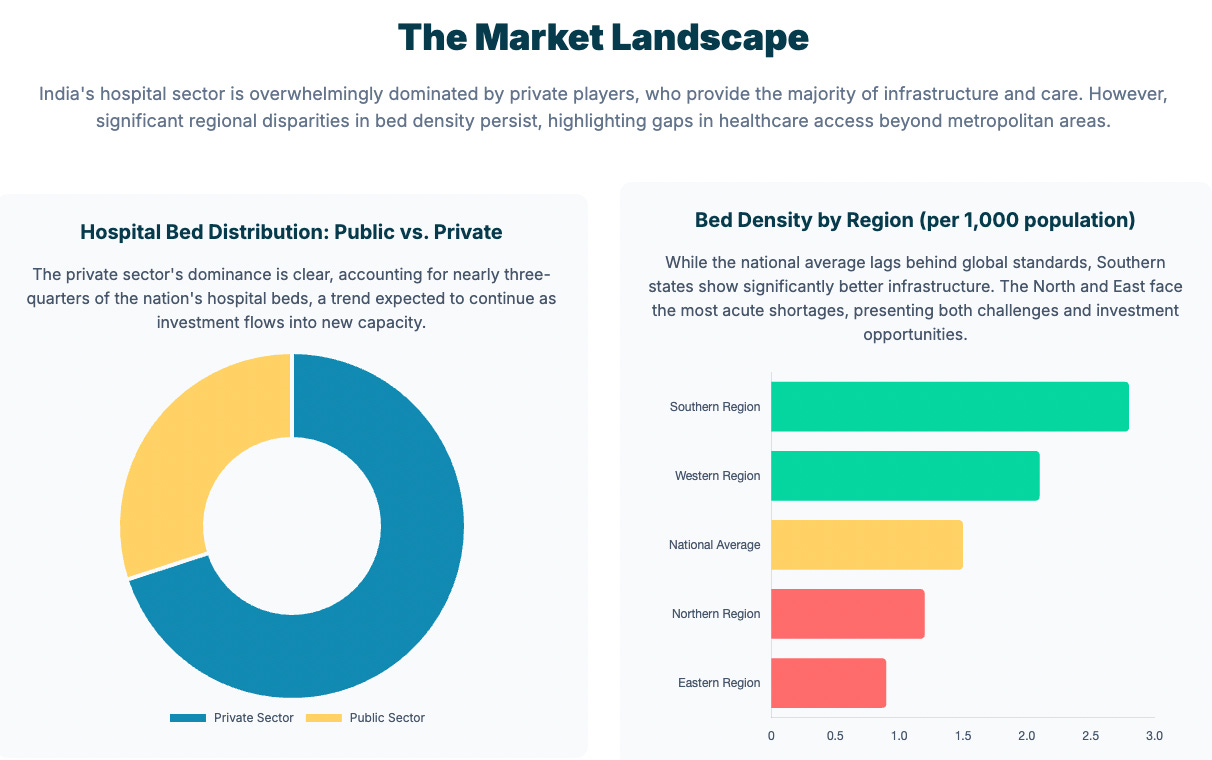

The structural segmentation reveals a critical disconnect. While the overall healthcare market (including healthtech, pharma, etc.) is projected to reach $638 billion by FY2025, the hospital segment alone captures roughly 70% of this value. Capacity, however, remains skewed. Metro cities report a bed density of 2.7 to 3.0 per 1,000 people, a stark contrast to the 0.8–1.2 beds per 1,000 found in Tier-2 and Tier-3 cities. This capacity mismatch is the primary strategic vector for corporate expansion.

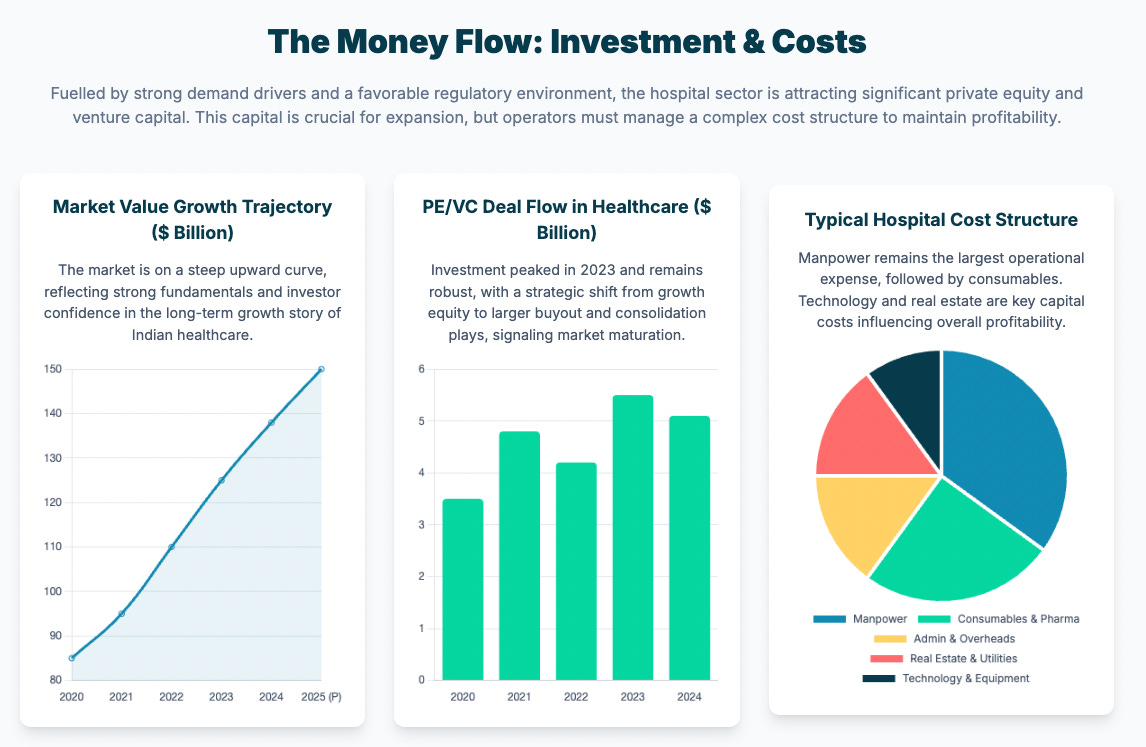

Financial Resilience and Private Capital Dominance

The narrative of institutionalisation is unequivocally driven by capital. Over the last five years, Private Equity (PE) and Venture Capital (VC) inflows into healthcare have exceeded $15.5 billion. Specifically, the hospital segment attracted $4.96 billion in PE and $6.74 billion in M&A deals between 2022 and 2024. This aggressive capital deployment is a wager on the sector’s financial resilience.

Listed corporate hospital chains are expected to maintain strong operational health, forecasting revenue growth of 15-17% and impressive Operating Profit Margins (OPM) of 23-24% for FY2025. This profitability underpins investor confidence, with hospital multiples growing to approximately 28x Enterprise Value/EBITDA, and high-Average Revenue Per Occupied Bed (ARPOB) facilities commanding up to 35x. The expected Return on Capital Employed (ROCE) is high, projected at 16–18% for FY2025.

A key indicator of pricing power and speciality mix is ARPOB. While sector leaders like Apollo Hospitals achieve an ARPOB in the range of ₹55,000–60,000 ($623-679) through high-value tertiary care in metros, volume-based models like Narayana Health maintain an ARPOB of ₹30,000–32,000 ($339-362), demonstrating differentiated but equally successful financial archetypes.

The Capacity Aggression Play

The industry is entering a definitive capacity expansion phase. Private hospitals are planning a cumulative capital expenditure (Capex) of approximately ₹25,000 crore ($2.83 billion) in FY2025 and FY2026. This aggressive, two-year capex cycle, estimated at ₹14,000–16,000 crore ($1.7 billion-1.81 billion), is a strategic response to both unmet demand and the availability of growth capital.

The preferred expansion strategy is shifting. The preference for quick scale-up is driving corporate chains, often bankrolled by private equity, to favour the “roll-up strategy” - the acquisition of existing regional hospitals, over complex greenfield developments. Concurrently, asset-light models, such as franchising and management contracts, are emerging as key strategies to improve capital efficiency and penetrate high-growth, lower-cost Tier-2 and Tier-3 markets. These non-metro regions are exhibiting superior growth, with compounding rates of 16-18%, outpacing the 12-14% growth seen in metros, driven by lower land costs and a critical deficit of high-quality care.

Part II: The So What: Structural Tensions and Investor Playbooks

The Economics of Profitability: ARPOB and the Speciality Mix

The core driver of profitability lies in the management of two variables: bed utilisation and speciality mix. ARPOB growth is consistently driven by three factors: improving payor mix, increasing the proportion of high-value tertiary care (e.g., oncology, organ transplant), and annual tariff hikes. The high-multiple valuations are not applied universally; they are reserved for hospitals that demonstrate superior capacity to execute on a premium speciality mix.

The trade-off between growth and cost is now manifest in the Tier-2 opportunity. While smaller hospitals in these regions exhibit higher revenue CAGRs (16–18%), cost metrics can be complex. In one analysis, the cost per bed day in In-Patient Departments (IPD) was found to be highest in Tier-2 city hospitals compared to Tier-1, suggesting that initial operational efficiencies can lag behind top-line growth.

The Policy-Market Interplay: The ‘Ayushman Bharat’ Constraint

The policy ecosystem, particularly the flagship public insurance scheme, Ayushman Bharat PM-JAY, presents a significant operational tension. While the scheme covers approximately 40% of India’s population (55 crore/ 550 million beneficiaries), engagement with publicly funded schemes remains challenging for many private operators. Only 13% of private hospitals were empanelled in a case study in Maharashtra, with key challenges cited as low reimbursement rates, complex claims processes, and administrative burden. There is also evidence suggesting that some private hospitals engage in “upcoding” following adjustments to reimbursement rates, indicating a fundamental friction between mandated affordability and institutional profitability.

Crucially, the absence of robust, standardised cost accounting systems in the private sector creates a vicious cycle. Without adequate cost data, policymakers struggle to set accurate and sustainable PM-JAY reimbursement rates, which in turn discourages private participation and complicates essential public-private collaboration.

The Human Capital Crisis: The Cost Headwind

The most persistent operational headwind is the human capital deficit. The cost structure of private hospitals is heavily weighted toward medical staff salaries, estimated at approximately 50% of total operational costs. India faces a persistent shortage of skilled personnel, with the doctor-to-population ratio estimated at either 1:834 or 1:1,500, depending on the availability metric used. The nursing ratio is acutely low at 2.10 per 1,000. This scarcity translates directly into high staff attrition (one major chain reported a nurse attrition rate of 25%) and upward wage pressure, acting as a structural constraint on margin expansion.

Part III: Why Now: The Catalysts of Acceleration

Capital Innovation: REITs, Private Credit, and FDI

The current acceleration is deeply rooted in financial innovation. Foreign Direct Investment (FDI) inflows into the sector reached $3.2 billion between 2022 and 2024, leveraged by India’s policy permitting 100% FDI in hospitals under the automatic route.

Beyond traditional PE/VC, two novel funding mechanisms are gaining traction:

REIT-like Models: The surge in capital raising through hospital IPOs signals high investor appetite. The growth of India’s Real Estate Investment Trust (REIT) sector, with a 68% market cap increase since 2020, suggests a future path for separating the core real estate assets from hospital operations, freeing up capital for further expansion.

Private Credit: Private credit funds are increasingly active, particularly in addressing the working capital gap. A niche model is emerging to provide financing to small and mid-sized hospitals against cashless insurance receivables, tackling the multi-billion dollar gap created by delayed insurer payments and thereby improving the operational liquidity of smaller operators.

The Digital Imperative and the AI Dividend

Technology is shifting from an optional expense to a mandatory lever for efficiency and scalability.

EHR Adoption: While only approximately 35% of Indian hospitals have implemented Electronic Medical Record (EHR) systems, the market size is projected to expand at an 8.18% CAGR. Adoption is highly concentrated in large urban facilities, underscoring a critical digital divide.

AI for Efficiency: Artificial Intelligence (AI) and automation are crucial for combating high labour costs. AI-based scheduling systems have demonstrated up to a 25% increase in resource utilisation and annual savings of up to $750,000 in major chains. This deployment of AI to free up administrative time for clinical staff is a direct response to the human capital crisis.

The Scalability Solution: Technology, particularly telemedicine, is the only scalable solution to the geographic and specialist divide, enabling early diagnosis and condition management in remote areas, thus easing the patient migration load on overburdened urban tertiary facilities.

Part IV: What Now: Strategic Imperatives for 2025–2030

Strategic Outlook: Growth and Sensitivity

Corporate hospital revenues are forecasted to grow at a healthy 10–12% year-on-year in fiscal 2025 and 2026. This outlook is fundamentally underpinned by long-term structural tailwinds such as the ageing population, NCD burden, and rising income, which mitigate severe downside risk in the base case. The most critical sensitivity, however, lies in Capex execution. The ambitious capacity expansion plans make the success rate of project delivery the primary determinant of achieving the high-end growth forecasts.

Stakeholder Playbooks

For Investors: The focus is on Buyout deals for large, scalable assets that offer a platform for regional consolidation. Diligence must prioritise a hospital’s regional ‘moat’ (pricing power and patient loyalty), the execution risk of its capacity expansion pipeline (brownfield vs. greenfield), and its effective integration of digital technologies to manage the labour-cost headwind. High-growth, asset-light segments, such as specialised care verticals (oncology, IVF, nephrology), remain compelling for Growth Equity.

For Operators: Survival and superior returns will depend on capital efficiency. This means prioritising expansion in Tier-2 and Tier-3 cities using asset-light models (management contracts/franchises) and deploying AI and automation tools aggressively to manage operating expenditure and combat high staff attrition. Pricing power must be continuously defended through differentiation in quaternary care.

For Policymakers: To effectively crowd-in private capital and align it with public health goals, reforms must focus on integrating cost accounting systems to set transparent, efficient, and sustainable reimbursement rates for public schemes. Furthermore, targeted subsidies (e.g., providing free land) and robust Public-Private Partnership (PPP) frameworks are essential levers to ensure private sector participation in underserved areas, enabling hospitals to accelerate breakeven while still serving PM-JAY patients.

Risks and The Road Ahead

The sector faces three primary risks:

Regulatory Risk: Stemming from potential downward pressure on pricing or rigid reimbursement structures under large public schemes.

Human Capital Risk: A critical shortage and high attrition rate for doctors and nurses act as a structural cap on scalability.

Macro Risk: While demand is inelastic, any severe economic slowdown could pressure Out-of-Pocket Expenditure (OOP) patients, which still accounts for a high 39.4% of Total Health Expenditure.

The necessary reforms for 2025–2030 are clear: a concerted effort to increase public spending towards the 2.5% of GDP target; a massive investment in medical education capacity to address human resource deficits; and a greater state-level focus on strengthening rural primary and secondary care to relieve the load on urban tertiary facilities.

To wrap up:

India’s hospital system is a dual asset - an economic engine generating high growth and employment, and a critical social necessity. Sustainable growth demands a careful balance of institutional profitability with the expansion of affordable access. The current phase of institutionalisation and aggressive capital deployment provides the resources for this growth. The ultimate success of the Indian hospital sector, however, will be measured not just by its EBITDA multiples, but by its capacity to solve the capacity and human resource deficit, transforming the calculus of care from a purely urban, elite service to a genuinely scalable, national asset.