Why is beating Zerodha so hard?

Unboxing their strategy in under 3 mins

Ahead of Groww’s IPO, getting a visual of how the brokerage landscape has shaped so far feels like second nature. Groww has been a phenomenal story - venture capital’s answer to Zerodha, who refused to let them in their house. Tiger backed Upstox is also in the race, albeit a bit behind.

For all these megabrokers, the trajectory has been more or less similar - starting with discount broking or mutual fund distribution, then fund house and later, having ambitions of being a supermarket for financial products (manufactured by own or selected third parties). With all playing the same game in a commoditized but high-growth space and targeting the same users, the user acquisition cost is rising fast. I still remember the days Zerodha would pay a straightforward 1,000 rs referral fee and Upstox would be 1,500 or so. Don’t quote me on the figures but this is what I can recollect.

With this referral scheme, came a flush of influencers sharing their referral links to open an account with Zerodha (or Groww or Upstox). All brokerages sponsored influencer content left and right, placing themselves everywhere. Even Tanmay Bhat started a show on investing…and ofcourse, many influencers followed.

For brokerage firms, this was an easier way to get the reach needed at a lesser cost than alternative paid channels. But the growing tribe of these so called ‘financial influencers’ caused a menace amongst the retail investors and as a result, SEBI finally put a stop to this in 2024. Some influencers were also running live trading classes to maximize their cut out of the brokerage income. Thank god that the crazy of that era is past us.

To add to the woes, the stock exchanges also levelled the fee structure for brokerages. Previously, exchanges used to charge slab-wise fees from stock brokers based on their turnover. Higher the volume, lower the fees. This was an added advantage for those moving volumes. However, SEBI leveled the paying field mandating uniform fees. This has left a lower scope for competing based on pricing.

Now that everyone is on ground zero again, the race to user acquisition has become tougher. Can’t pull on pricing, can’t push via influencers. In addition to that, new players keep making space for themselves. The latest entry to the big leagues is Dhan.

Amongst all this, one brokerage firm is playing a different game. It is none other than Zerodha.

So what is Zerodha doing differently?

Let me take a quick detour to ask you a different question.

Do you remember LearnApp? The app that teaches you how to invest and trade? No? All traders born in the covid boom would surely know of it. LearnApp guys got top traders and investors such as Radhika Gupta, Ashish Chauhan, Vishal Kapoor, Mahesh Patil, etc to teach a course. Kamaths were their investors in the company.

LearnApp did well when the markets were booming, but once the market started going through the dry patch, so did LearnApp’s subscriptions. This is natural for this industry. They had a big team of production, editing, marketing etc. working for them. It did not make sense to hold on to the entire team, looking at the business numbers…BUT it didn’t even make sense to let go of all these talented folks who have acquired a good taste now in creating A+ financial content.

Enter the Kamaths…once again.

With SEBI’s new guard up, the influencer referral system was no longer a valid way to grow infinitely.

Zerodha can’t incentivize influencers directly - SEBI won’t allow that.

Zerodha can’t run ads, because Kamaths have done a fairly successful PR campaign around how they are against it.

Zerodha can’t sponsor content either, because to the audience it feels just like advertising - like you’re trying to sell something.

So, Kamaths do the same thing aka sponsoring content but just by packaging it differently.

This is the genius of Zerodha!

Zero1 Media, a JV between Zerodha and LearnApp is born which becomes the vehicle to do exactly that.

It lets Zerodha continue renting eyeballs and at the same time acts as a saviour for the immensely talented folks at LearnApp. A brilliant move!

What is Zero1 Media and why is it so amazing?

The idea of ‘Zero1 by Zerodha’ - the way it is pronounced, is owning the entire narrative around topics such as personal finance, investing, trading, business, etc. It keeps Zerodha culturally relevant and forward looking.

Zero1 produces their own shows as well as sponsors authentic content creators with a decent following. This allows Zerodha to reach far and wide, and label themselves as supporters of creators rather than ‘sponsors,’ with the same incentives at play. Some of the best youtube content creators of today’s time will have ‘Zero1 by Zerodha Network’ plastered everywhere.

This is a part of their broader strategy, which aims to create awareness, educate, motivate people to open an account and then finally monetize through their transactions. It’s a long term bet which will inevitably pay off in a big way.

You can draw some parallels here to a16z - a venture fund which is heavy on content creation and distribution. Benedict Evans once called them a media company which monetizes through venture investments. Same can be said about Zerodha - it is transforming itself into a media company that monetizes through financial platforms and products.

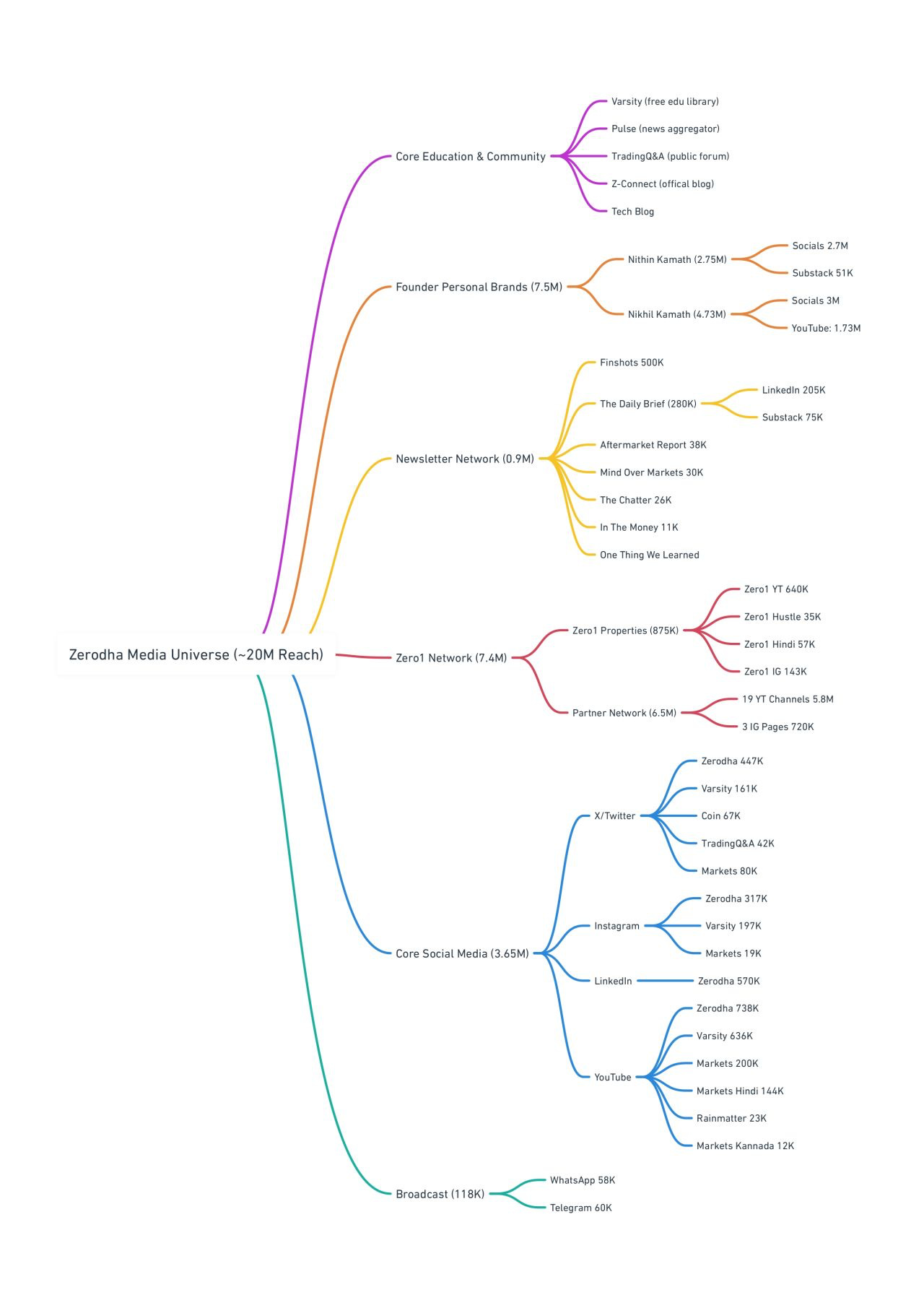

This is what their content and media engine looks like:

Take a moment to think about this - while other brokers are competing for today’s customers, Zerodha is busy giving birth to tomorrow’s customers.

The Indian markets are still low on demat penetration ( < 12%) vs the US market ( > 50%). The market penetration will surely mature in the time to come. A company like Zerodha which is prioritizing financial education is bound to be culturally significant to drive this change.

It is the Nescafe in Japan, all over again. I will explain how, if you have the patience for it:

After World War II, Nestlé introduced coffee to Japan, expecting massive success. The product was well-tested, affordable, and supported by strong advertising. Yet, the Japanese simply didn’t buy it. No campaign worked. The issue wasn’t price or quality, it was culture. Japan was a tea-drinking nation with no emotional connection to coffee.

In 1975, Nestlé invited French psychoanalyst Clotaire Rapaille, known for studying emotional associations in consumer behaviour, to investigate. Through memory-based experiments, he discovered that the Japanese had no “coffee imprint” - no memories or emotions linked to it.

Rapaille advised Nestlé to stop trying to sell coffee to adults and instead introduce coffee-flavoured candies to children. If kids grew up loving the flavour, they’d carry that emotional imprint into adulthood. Nestlé followed his suggestion, flooding Japan with coffee-flavoured sweets that became a youth sensation. Parents tried them too, slowly developing a liking for the taste. The fact that Nestlé already manufactured candy, also helped.

A decade later, those candy-loving kids had grown up into working adults. When Nestlé reintroduced instant coffee, it resonated perfectly. Instant coffee sales exploded, and Nestlé became Japan’s coffee market leader.

Japan today imports 500,000 tons of coffee annually.

Barely 60 years earlier, it was a market that hardly sold a cup!

It is brilliant long-term brand building - teaching that before selling a product, you must first plant its memory.

This is something which is difficult to engineer for companies which run on quarterly timelines or have investor pressure to meet certain periodic benchmarks. Yes, I’m talking about the funded/publicly listed peers. Zerodha has none of this, and can afford to act with conviction…to see the other side of the tunnel with these long-term bets.

Zerodha afterall, is selling financial products to an FD and gold-loving nation.

To end, there are three ingredients of legendary companies:

One is to be able to see what tomorrow will bring, and not just to create a company which fits in the frame of today.

Second, is the ability to attract talented people, get them to buy into your vision, even in difficult times.

And third, is the courage to survive until the market catches up to the reality you’re building for.

On all three, Zerodha looks stronger than others.